Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

S&P 500 closed Friday 2/20 at 6910, up 0.7% despite awful 1.4% GDP growth report and hot rising PCE inflation [View all]

This discussion thread is pinned.

Last edited Sun Feb 22, 2026, 02:37 AM - Edit history (252)

In the future I will only be doing these twice a week: Tuesday and Friday, unless it's really interesting.This is getting unsustainable, I'm spending about 7 hours a week producing two updates.

10 Year TREASURY YIELD 4.09% on Feb 20, up 0.01 for the day. It was 4.27% on Feb 3. It was 4.19% on Friday 12/12 (It local-bottomed out at 3.95% 10/22/25, its lowest point since April.)

https://finance.yahoo.com/quote/%5ETNX/

10 Year Treasury price: https://finance.yahoo.com/quote/ZN%3DF/

Bitcoin: $68,597 @ 2/21 148p # It was $75,512 @ 6:50 PM ET Feb 3. It was $84,009 @ 944pm ET Friday 1/30. It was $95,401 @ 533p ET 1/16/26, It recently exceeded at last it's end of year 2024 closing level ($93,429), but it's back below the waterline on that metric, , It's in bear market territory, down more than 20% from it's $126,000+ all-time high in October (20% down from $126,000 is $100,800) ACTUALLY, it's down 46% from $126,000 (Cryptocurrencies trade 24/7) https://finance.yahoo.com/quote/BTC-USD/

Next Fed rate decision: March 18 (last was January 28)

CME FedWatch tool (probabilities of various Fed interest rate moves) 1/30: 13% chance of a rate cut), 2/10: 20% chance, 2/13: 9% chance, 2/20: 3% chance

. . . https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The S&P 500 closed Friday February 20 at 6910, up 0.7% for the day,

and up 19.5% from the 5783 election day closing level,

and up 15.2% from the inauguration eve closing level,

and up 17.5% since the December 31, 2024 close

and up 0.9% Year-To-Date (since the December 31, 2025 close)https://finance.yahoo.com/quote/%5EGSPC

(more below on the S&P 500 levels corresponding to the above, and also the Dow)

Market news of the day: https://finance.yahoo.com/

How to find the latest Yahoo Finance "stock market today" report if it's not at the finance.yahoo page (note that the headline displayed there does not include the "Stock Market Today" words, but the article itself does): click on

https://www.google.com/search?q=%22stock+market+today%22+site%3Afinance.yahoo.com&oq=%22stock+market+today%22+site%3Afinance.yahoo.com

If the link doesn't work for you,

Google: "stock market today" site:finance.yahoo.com

First I will briefly cover Thursday. Then on to Friday

Thursday Feb 19

S&P 500 down 0.28%, Dow down 0.54% (267 points), NASDAQ down 0.31%, snapping a 3-session win streak for these indexes.

Stock market today: Dow, S&P 500, Nasdaq slip as oil prices continue rally amid Iran-US tensions, Yahoo Finance, 2/19/26

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-slip-as-oil-prices-continue-rally-amid-iran-us-tensions-210046882.html

US stocks retreated on Thursday as US-Iran fears spurred a continued rally in oil, with Walmart (WMT) earnings and Federal Reserve rate-cut odds in focus.

The pullback came as oil extended its biggest daily jump since October amid growing worries of a US military attack on Iran, a major oil producer. Contracts for both Brent (BZ=F) crude and West Texas Intermediate (CL=F) rose more than 2% after President Trump said he would decide on whether to strike Iran within the next 10 days.

Meanwhile, Treasurys were set for their longest run of losses in a month amid oil-driven inflation concerns.

Earnings continue, with Walmart (WMT) posting a modest quarterly beat but flagging headwinds in its guidance for the year ahead. Shares fell over 1% Thursday.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-slip-as-oil-prices-continue-rally-amid-iran-us-tensions-210046882.html

US stocks retreated on Thursday as US-Iran fears spurred a continued rally in oil, with Walmart (WMT) earnings and Federal Reserve rate-cut odds in focus.

The pullback came as oil extended its biggest daily jump since October amid growing worries of a US military attack on Iran, a major oil producer. Contracts for both Brent (BZ=F) crude and West Texas Intermediate (CL=F) rose more than 2% after President Trump said he would decide on whether to strike Iran within the next 10 days.

Meanwhile, Treasurys were set for their longest run of losses in a month amid oil-driven inflation concerns.

Earnings continue, with Walmart (WMT) posting a modest quarterly beat but flagging headwinds in its guidance for the year ahead. Shares fell over 1% Thursday.

--- SCROLLING DOWN THE PAGE, Thursday February 19 -----

Wall Street points to signs the AI scare sell-off is overblown

Eric Trump shrugs off bitcoin's recent slump: 'If you don't have the backbone ... go invest in some boring bond'

Mortgage rates fall to lowest level since September 2022 as applications, starts both grow

Thirty-year loans averaged 6.01% last week, down from the previous week's reading of 6.09% and a pullback from an average of 6.85% a year ago.

Data on November housing starts showed a 3.9% month-on-month increase, below economists' estimates of 4.9% but above the previous month's 4.6% decline.

Data on November housing starts showed a 3.9% month-on-month increase, below economists' estimates of 4.9% but above the previous month's 4.6% decline.

Blue Owl's retail private credit fund halts redemptions

US trade deficit climbs more than 30% in December to $70.3 billion, widens for second month in a row (more on that in the Calendar section, along with Commerce Dept's report today of 2024 and 2025 trade deficits)

Initial jobless claims come in below expectations, largest decline since November (more on that in the Calendar section)

From Wednesday but worth another day in the highlights --

BofA: Corporate profits rise while labor income falls, 'fueling K-shaped economy'

*There's a graph from 2006 on: Wages and salaries as a percent of GDP, compared to Corporate profits as a percent of GDP

The wages and salaries, at about 7.4% of GDP in the latest point on the graph, is lower than any point on the graph, per progreerian eyeballs

------- OTHER ARTICLES 2/19/26 ---------

How Major Indexes Fared, AP, 2/19/26

https://finance.yahoo.com/news/major-us-stock-indexes-fared-212044224.html

For the day (see above), for the week (mostly up),

for the year (YTD) S&P 500 +0.2%, Dow: +2.8%, Nasdaq: -2.4%, Russell 2000 +7.4%

US leading indicators forecast slow start to 2026, Wall St. Journal via MSN, 2/17/26 (more in Calendar section)

Friday February 20

Stock market today: Dow, S&P 500, Nasdaq jump to post weekly gains as Supreme Court strikes down Trump tariffs, Yahoo Finance, 2/20/26

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-to-post-weekly-gains-as-supreme-court-strikes-down-trump-tariffs-210043602.html

US stocks rose on Friday after the Supreme Court ruled that President Trump's most sweeping "Liberation Day" tariffs are unlawful, saying he lacked the authority to impose them using emergency powers.

Stocks reversed course on the heels of the decision as investors kept an eye out for US-Iran tensions and private credit jitters. ((see Blue Owl story Thursday above -progree))

In response, President Trump said in a press conference that his administration will be placing a "10% global tariff" to replace the duties struck down by the high court. ((later: Saturday he announced 15% -progree))

Wall Street learned earlier Friday that US GDP grew more slowly than expected in the fourth quarter, coming in at 1.4%, far behind forecasts. Meanwhile, the "core" personal expenditures index — Fed rate-setters' preferred gauge of inflation — rose more than expected in December, on a monthly and annual basis. ((the CORE measure, which does not include food and energy, is the Fed's preferred predictor of FUTURE inflation. Anyway, it rose +0.4% in December and to +3.0% year-over-year. The regular measure, which includes food and energy rose +0.4% in December and to +2.9% year-over-year. There's more on that in the Calendar section, including a pointer to the must-see graphs showing clearly the trend is up https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3619273 -progree))

The watch is on for signs of stress in the private credit sector, after Blue Owl's (OBDC, OWL) halt to withdrawals. Fears are the move is a "canary in the coal mine" financial crisis-style moment amid concerns about the sector's holdings of software stocks threatened by AI.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-to-post-weekly-gains-as-supreme-court-strikes-down-trump-tariffs-210043602.html

US stocks rose on Friday after the Supreme Court ruled that President Trump's most sweeping "Liberation Day" tariffs are unlawful, saying he lacked the authority to impose them using emergency powers.

Stocks reversed course on the heels of the decision as investors kept an eye out for US-Iran tensions and private credit jitters. ((see Blue Owl story Thursday above -progree))

In response, President Trump said in a press conference that his administration will be placing a "10% global tariff" to replace the duties struck down by the high court. ((later: Saturday he announced 15% -progree))

Wall Street learned earlier Friday that US GDP grew more slowly than expected in the fourth quarter, coming in at 1.4%, far behind forecasts. Meanwhile, the "core" personal expenditures index — Fed rate-setters' preferred gauge of inflation — rose more than expected in December, on a monthly and annual basis. ((the CORE measure, which does not include food and energy, is the Fed's preferred predictor of FUTURE inflation. Anyway, it rose +0.4% in December and to +3.0% year-over-year. The regular measure, which includes food and energy rose +0.4% in December and to +2.9% year-over-year. There's more on that in the Calendar section, including a pointer to the must-see graphs showing clearly the trend is up https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3619273 -progree))

The watch is on for signs of stress in the private credit sector, after Blue Owl's (OBDC, OWL) halt to withdrawals. Fears are the move is a "canary in the coal mine" financial crisis-style moment amid concerns about the sector's holdings of software stocks threatened by AI.

--- SCROLLING DOWN THE PAGE, Friday February 20 -----

Stocks rise after Trump emergency tariffs struck down by Supreme Court

https://finance.yahoo.com/news/supreme-court-strikes-down-trumps-blanket-tariffs-151806658.html

Cybersecurity stocks fall, re-sparking fears of AI disruption

Cybersecurity software stocks fell on Friday after Anthropic announced a new security capability for its Claude AI model, resurfacing concerns of sector-wide disruption.

Trump says he'll impose 10% 'global' tariff, blasts Supreme Court (6-3 vote)

The Supreme Court's ruling on Friday leaves tariffs implemented under Section 232 of the Trade Expansion Act of 1962 — which cite national-security concerns — unchanged, keeping in place a range of import duties on products ranging from copper and semiconductors to automobiles and wood products such as cabinetry.

Section 232 tariffs include 50% levies on imports of semi-finished copper products, 25% levies on certain imported semiconductors — including Nvidia's (NVDA) H200 chips — and automobile tariffs, including 25% levies on trucks and 10% levies on buses.

Section 232 tariffs include 50% levies on imports of semi-finished copper products, 25% levies on certain imported semiconductors — including Nvidia's (NVDA) H200 chips — and automobile tariffs, including 25% levies on trucks and 10% levies on buses.

Furniture, cookware stocks move higher as NRF says Supreme Court ruling provides 'certainty'

((a few more articles on the impact of the Supreme Court's tariff rulling))

CoreWeave stock sinks after report lenders worried about its creditworthiness

. . . Blue Owl (OWL) has spent most of the time in the headlines this week over its decision to halt redemptions from a private credit fund (the company will instead return capital to shareholders on its own terms). Overall, the firm has continued to serve as the poster child of any worried about private credit in the market.

But the CoreWeave story — along with Oracle (ORCL) — will also remain a key canary on any fears investors have about the durability or reliability of the AI data center build-out .

But the CoreWeave story — along with Oracle (ORCL) — will also remain a key canary on any fears investors have about the durability or reliability of the AI data center build-out .

Fed's favored inflation gauge ticks up 0.4% in December, in sign inflation remains sticky - both the regular PCE and the core PCE increased by 0.4% in December when 0.3% was expected for both - see Calendar section for more

((here's the personal income and spending part of the report -progree))

Meanwhile, personal income remained consistent, rising 0.3% in December on a monthly basis, in line with the previous month's growth and matching economist expectations.

Personal spending increased 0.4% from last month, coming in above expectations of 0.3% but falling below the previous month's growth of 0.5%.

Personal spending increased 0.4% from last month, coming in above expectations of 0.3% but falling below the previous month's growth of 0.5%.

US GDP growth disappoints, Trump blames government shutdown - see Calendar section for the shocking 1.4% annualized growth rate in Q4.

================================

CALENDAR

Recent and Coming Up, Reports (I'm also keeping February 9 and later ones for now, I put the older ones in reply #1

https://www.marketwatch.com/economy-politics/calendar

See Reply #1 to this thread for reports prior to February 9.

The government reports are all seasonally adjusted, as are most, if not all, of the non-government reports the media covers, so please don't post comments about how the numbers look good (or not as bad as expected) only because of Christmas season hires or Christmas shopping. Or that it's warming up and people are beginning spring shopping already -- seasonal factors like that have been adjusted for

THIS WEEK'S REPORTS (FEB 16-20) FOLLOWED BY NEXT WEEK'S CALENDAR (FEB 23-27)

MONDAY FEB 16

None scheduled, President's Day holiday

TUESDAY FEB 17

Nothing

WEDNESDAY FEB 18

# Housing Starts for November and December

Housing starts jump to 5-month high in December

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "housing starts"

Yes, I wish Yahoo would give these articles their own URL.The number of new single-family homes under construction in December hit an annualized rate of 1.4 million homes, up 6.2% from November and ahead of forecasts for an annualized rate of 1.32 million homes, according to data from the Census Bureau. This pace of building, however, is still 7.3% below December 2024.

This report followed Tuesday's read on homebuilder confidence from the NAHB, which showed sentiment fell by another point to 36 this month, the lowest reading since September.

**FRED graph shown in the article, graph is titled: "New Privately-Owned Housing Units Started, Total Units" from 2016 onward

# Building Permits for November and December

December was 1.32 million vs. 1.31 million expected and 1.27 million previously, according to https://www.marketwatch.com/economy-politics/calendar

# Durable Goods Orders for December

Durable goods orders were down 1.4% in December vs. down 2.0% expected, and +5.4% previously according to https://www.marketwatch.com/economy-politics/calendar . I believe these are seasonally adjusted. I don't have an explanation, I haven't looked for an article.

# Industrial Production and Capacity Utilization for January

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "industrial production"

Yes, I wish Yahoo would give these articles their own URL.

US industrial production grew in January by widest monthly margin since March 2025 (+0.7%. It was the largest month-on-month percentage increase since March 2025,Compared to a year ago, industrial production and manufacturing activity were up 2.3% and 2.4%.

# Minutes of Fed's January FOMC meeting

THURSDAY FEB 19

# Leading economic index for December Conference Board (non-governmental)

US leading indicators forecast slow start to 2026, Wall St. Journal via MSN (no paywall), 2/17/26

https://www.msn.com/en-us/money/markets/us-leading-indicators-forecast-slow-start-to-2026/ar-AA1WG60g

ULTIMATE SOURCE: https://www.conference-board.org/topics/us-leading-indicators/index.cfm

# Unemployment insurance claims

US weekly jobless claims fall more than expected amid labor market stability (dropped 23k to 206k in week ending Feb 14 ## Continuing claims week ending Feb 7 ROSE 17k to 1.869 M), Reuters, 2/19/26

https://finance.yahoo.com/news/us-weekly-jobless-claims-fall-134542016.html

. . .continuing claims suggested that laid-off workers were experiencing difficulties finding new positions.

The median duration of unemployment is near four-year highs. The lack of hiring has significantly impacted recent college graduates, who because of no or limited work history, cannot file for unemployment benefits and are not captured in the claims data.

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf

This report's permalink: https://www.dol.gov/newsroom/releases/eta/eta20260219

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

# U.S. trade deficit for December (the Commerce Dept)

U.S. trade deficit slipped to $901 billion last year amid Trump tariffs, AP, 2/19/26

https://finance.yahoo.com/news/u-trade-deficit-slipped-901-134134850.html

From $904 billion in 2024 to $901 B in 2025.

The trade gap surged from January-March as U.S. companies tried to import foreign goods ahead of Trump’s taxes, then narrowed most of the rest of the year.

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Friday on GDP)

# Advanced U.S. trade balance in goods for December

See above AP story

# Mortgages rates

Mortgage rates drop to lowest level in nearly 4 years

https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-rates-drop-to-lowest-level-in-nearly-4-years-110045487.html

FRIDAY FEB 20

# GDP Q4 FIRST ESTIMATE

2.5% annualized growth expected, 1.4% is what happened according to the Commerce Department's Bureau of Economic Analysis (BEA)

Q3 was 4.4% annualized rate (I know I know, but the AI spending counts as GDP, even if it produces nothing useful)

Yes, the reported GDP numbers are inflation-adjusted

Full year GDP's: 2024: 2.8%. 2025: 2.2%

LBN Thread: https://www.democraticunderground.com/10143619093

ULTIMATE SOURCE:

. . . https://bea.gov/data/gdp/gross-domestic-product

. . . https://bea.gov/news/current-releases

. . . https://bea.gov/news/2026/gdp-advance-estimate-4th-quarter-and-year-2025

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Thursday on trade balance)

# PCE Inflation for December - Fed's favorite inflation gauge

Expected: month-over-month: 0.3%, year-over-year: 2.8% (both numbers same as November's)

What happened: month-over-month: regular PCE (includes food and energy) +0.4%

Core PCE (doesn't include food or energy): +0.4%

12 month average (year-over-year): regular PCE: +2.9%, core PCE: +3.0%

LBN thread (this leads off with the GDP, but also includes PCE inflation): https://www.democraticunderground.com/10143619093

GRAPHS: rolling averages of 3 months and 12 months. And month-over-month bar chart. Both regular and core:

. . . https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3619273

This inflation gauge fully includes substitution effects, so for example if beef prices are way up and a lot of consumers switch to turkey necks, this inflation gauge will show a subdued rise or even a drop in the meat price index. But I suspect the Fed likes it because it tends to produce a lower inflation rate than the CPI.

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

. . . PCE DATA SERIES: https://fred.stlouisfed.org/series/PCEPI

. . . CORE PCE DATA SERIES: https://fred.stlouisfed.org/data/PCEPILFE

# Personal Income and Spending for December

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

# S&P flash U.S. services PMI for February

# S&P flash U.S. manufacturing PMI for February

# New home sales for November and December

# Consumer sentiment (prelim) for February

Consumer sentiment in February shows high prices weigh on US households, but Supreme Court could offer relief, Yahoo Finance, 2/20/26 https://finance.yahoo.com/news/consumer-sentiment-in-february-shows-high-prices-weigh-on-us-households-but-supreme-court-could-offer-relief-161122277.html

The University of Michigan's Index of Consumer Sentiment for February came in at 56.6, up 0.4% from January, but below last year's level of 64.7. The small increase was lower than the 57.2 reading expected by economists. (Be sure to look at the graph that shows the scale of the teeny tiny up-tick still leaving it at incredibly low levels historically.

ULTIMATE SOURCE: https://www.sca.isr.umich.edu/

GRAPH, 10 years: https://www.sca.isr.umich.edu/files/chicsr.pdf

GRAPH, 50 years: https://www.sca.isr.umich.edu/files/chicsh.pdf

NEXT WEEK'S CALENDAR (FEB 23-27)

MONDAY FEB 23 (CALENDAR)

# Factory orders December

TUESDAY FEB 24 (CALENDAR)

# S&P Case-Shiller home price index (20 cities), December

# Consumer confidence, February

WEDNESDAY FEB 25 (CALENDAR)

Nothing

THURSDAY FEB 26 (CALENDAR)

# Unemployment insurance claims

FRIDAY FEB 27 (CALENDAR)

# PPI Producer Price Index aka wholesale prices, January - last time the month-over-month was a whopping 0.5%, that's roughly a 6% annualized rate, and the year over year was 3.0% (the core PPI year-over-year was 3.5%). The Krasnov Krasnov! Brigade was eerily silent about that one.

The full calendar: https://www.marketwatch.com/economy-politics/calendarRevised release dates for Bureau of Labor Statistics reports: https://www.bls.gov/bls/2025-lapse-revised-release-dates.htm

BEA.GOV news release schedule (they produce reports on the GDP, Retail Sales, PCE Inflation (the Fed's favorite inflation gauge), and Personal Consumption and Income: https://www.bea.gov/news/schedule

ADP NER Pulse (private payrolls weekly update): Is every Tuesday. The ultimate source: https://www.adpresearch.com/

and look for "NER Pulse"

Archives of previous reportsThe monthly payroll employment reports from the BLS are archived at Archived News Releases (https://www.bls.gov/bls/news-release/ ). In the list up at the top, under Major Economic Indicators, select Employment Situation ( https://www.bls.gov/bls/news-release/empsit.htm ) . That opens up links to reports going back to 1994. (Includes CPI, ECI, many others)

Unemployment insurance claims archives: https://oui.doleta.gov/unemploy/claims.asp . If that doesn't work, start with https://oui.doleta.gov/unemploy/claims_arch.asp and click on "Weekly Claims Data" near the very bottom.

BEA's Data Archive https://www.bea.gov/news/archive

LAST WEEK'S REPORTS (FEB 9-13)

MONDAY FEB 09

Nothing

TUESDAY FEB 10

# NFIB optimism index, January

US small-business confidence slipped in January, Wall St. Journal, 2/10/26 (no paywall or gimmicks at this MSN-hosted article)

https://www.msn.com/en-us/money/smallbusiness/us-small-business-confidence-slipped-in-january/ar-AA1W33sy

# US consumer delinquencies jump to highest in almost a decade, Bloomberg, 2/10/26

https://www.msn.com/en-us/money/markets/us-consumer-delinquencies-jump-to-highest-in-almost-a-decade/ar-AA1W4vwC

I haven't had time to read this article, but title is sure gloomy.

# Employment Cost index, Q4 - Considered the best statistic on wages/salaries and benefits, and the Federal Reserve's favorite source on the same.

Economy Group post: https://www.democraticunderground.com/1116101681

From the source: https://www.bls.gov/eci/

Some context:

The ECI shows changes in wages and benefits in a manner that fixes the composition of the workforce. This is important, particularly when there are large changes in employment, because these data are not subject to the same distortions as the monthly average hourly earnings series, which can artificially be increased when low-wage workers lose their jobs and drop out of the sample (as happened in 2020) or artificially be decreased when these same workers are hired back (as happened in 2021) [1].

By fixing workforce composition, the ECI provides a more accurate picture of what is actually happening to wages.

By fixing workforce composition, the ECI provides a more accurate picture of what is actually happening to wages.

[1] The Pandemic’s Effect on Measured Wage Growth, The WHite House, 4/19/21 ((Biden era))

. . . Original link now gone, thanks to Krasnov: https://www.whitehouse.gov/cea/written-materials/2021/04/19/the-pandemics-effect-on-measured-wage-growth/

. . . The Archive.org link: https://web.archive.org/web/20220208080743/https://www.whitehouse.gov/cea/written-materials/2021/04/19/the-pandemics-effect-on-measured-wage-growth/

# Import price index

This is another one I don't have time to look into now

# Retail sales - caution: not inflation-adjusted, so one gets a distorted view of increases in retail sales, when often most of that is simply due to price increases. It is seasonally adjusted.

RETAIL SALES DECEMBER over November: +0.0%, Inflation was 0.31%, so inflation-adjusted retail sales were down about 0.3% for the month

RETAIL SALES for the 12 month period through December (i.e. year-over-year): +2.4%, Inflation: +2.7%, so inflation-adjusted retail sales were down about 0.3% for the 12-month period

LBN Thread: https://www.democraticunderground.com/10143614155

From the Source: https://www.census.gov/retail/index.html -- > https://www.census.gov/retail/sales.html :

Remember the below numbers are not inflation adjusted

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USN), Not Seasonally Adjusted: +10.9% == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USN

. . . [] Advance Retail Sales: Retail Trade and Food Services (MARTSMPCSM44X72USS), Seasonally Adjusted: +-0.0% == https://fred.stlouisfed.org/series/MARTSMPCSM44X72USS

And so the seasonal adjustment process turned a 10.9% increase to 0.0% in December (remember it's the Christmas month ho ho ho)

CPI inflation: https://data.bls.gov/timeseries/CUSR0000SA0

WEDNESDAY FEB 11

# The big "First Friday" monthly BLS jobs report that produces the headline non-farm payroll jobs number and unemployment rate - January

Ultimate source of the latest release: https://www.bls.gov/news.release/empsit.nr0.htm

Permanent copy of this January report: https://www.bls.gov/news.release/archives/empsit_02112026.htm

LBN Thread: https://www.democraticunderground.com/10143614651

The before and after the big jobs revisions, month by month:

https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3615236

Here's a summary table showing the annual totals:

Annual Totals, in thousands

Year Before After Difference

2022] 4555 4526 -29

2023] 2594 2515 -79

2024] 2012 1459 -553

2025] 584 181 -403

2025 comes out to an average of 15k jobs/month. If you remove January, it is 21k/month. A barely above-the-waterline record.

And yet most media headlines are about a big surge in jobs (130,000) in January. 130,000 is not a big number, but relatively speaking it's a "surge" compared to the pathetic average monthly jobs growth in 2025.

The unemployment rate (from a separate survey, the Household Survey) fell from 4.4% to 4.3% (It was 4.0% in January 2025, a year ago)

The Household Survey's "Employed" number increased by just 689,000 since January 2025 ( 57,000 / month average ).

THURSDAY FEB 12

# Unemployment insurance claims

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf

This report's permalink: https://www.dol.gov/newsroom/releases/eta/eta20260212

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

In the week ending February 7, the advance figure for seasonally adjusted initial claims was 227,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 231,000 to 232,000.

...

The advance number for seasonally adjusted insured unemployment ((also known as continuing claims -progree)) during the week ending January 31 was 1,862,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 1,844,000 to 1,841,000.

...

The advance number for seasonally adjusted insured unemployment ((also known as continuing claims -progree)) during the week ending January 31 was 1,862,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 1,844,000 to 1,841,000.

# Existing home sales Jan.

Realtors report a ‘new housing crisis’ as January home sales tank more than 8%, CNBC, 2/12/26

https://www.cnbc.com/2026/02/12/january-homes-sales.html

. . . The chief economist for the National Association of Realtors, Lawrence Yun, is calling it “a new housing crisis.”

Sales of previously owned homes in January dropped a much wider-than-expected 8.4% from December to a seasonally adjusted, annualized rate of 3.91 million, according to the NAR. Sales were 4.4% lower than January 2025. That is the slowest pace since December 2023 and the biggest monthly drop since February 2022. The median price for a home sold in January was $396,800, up 0.9% year over year and the highest January price on record.

https://www.cnbc.com/2026/02/12/january-homes-sales.html

. . . The chief economist for the National Association of Realtors, Lawrence Yun, is calling it “a new housing crisis.”

Sales of previously owned homes in January dropped a much wider-than-expected 8.4% from December to a seasonally adjusted, annualized rate of 3.91 million, according to the NAR. Sales were 4.4% lower than January 2025. That is the slowest pace since December 2023 and the biggest monthly drop since February 2022. The median price for a home sold in January was $396,800, up 0.9% year over year and the highest January price on record.

FRIDAY FEB 13

# Consumer price index Jan.

LBN Thread: https://www.democraticunderground.com/10143615668

A lot of response from the Krasnov Krasnov! Brigade. But they were eerily absent when the latest PPI (Producer Price Index, aka Wholesale Prices) report reported a 0.5% increase in December (that's a 6.0% annualized rate), and 3.0% over the past 12 months (their core measure was 3.5% over the past 12 months) https://www.democraticunderground.com/10143608234 (see Reply #1 for more on that 1/30/26 report with the title, "Wholesale prices rise sharply and show new Fed chief could confront stubborn inflation" )

Back to CPI - here's the core part of it, which is considered by the Federal Reserve as more representative of underlying trends and more predictive of FUTURE inflation - assertions that have been back-tested. This one is a rolling 3 month average, so that it's more than a "One off" of the latest month, but with much more recency than year-over-year. It shows a distinctive up-turn

The regular CPI's 3 month rolling average also has risen the last 2 months in a row, although not as sharply. So much for "cooling inflation" I guess.

Chicago Fed's Goolsbee says interest rates could fall 'a fair bit more,' but more inflation progress is needed, Yahoo Finance, 2/13/26

https://finance.yahoo.com/news/chicago-feds-goolsbee-says-interest-rates-could-fall-a-fair-bit-more-but-more-inflation-progress-is-needed-210239035.html

He is concerned about services inflation which tends to be persistent and not driven by tariffs (so an easing of tariffs isn't going to help much with services inflation, and if the impact of tariffs is a one-time thing, as many think, that's not going to help with services inflation. Says inflation has been above the target for more than 4.5 years now)

Erika McEntarfer (fired former BLS Commissioner) "Person who was fired here - you should still trust BLS data." - The agency is being run by the same dedicated career staff who were running it while I was awaiting confirmation from the Senate. And the staff have made it clear that they are blowing a loud whistle if there is interference." https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3614986

=============================================

=============================================

=============================================

=============================================

The S&P 500 closed Friday February 20 at 6910, up 0.7% for the day,

and up 19.5% from the 5783 election day closing level,

and up 15.2% from the inauguration eve closing level,

and up 17.5% since the December 31, 2024 close

and up 0.9% Year-To-Date (since the December 31, 2025 close)

S&P 500

# Election day close (11/5/24) 5783

# Last close before inauguration day: (1/17/25): 5997

# 2024 year-end close (12/31/24): 5882

# Trump II era low point (going all the way back to election day Nov5): 4983 on April 8

# 2025 year-end close (12/31/25): 6845

# October 28 all-time-high: 6890.90, surpassed by December 24's all-time high of 6932.00

# Several market indexes: https://finance.yahoo.com/

# S&P 500: https://finance.yahoo.com/quote/%5EGSPC/

https://finance.yahoo.com/quote/%5EGSPC/history/

# S&P 500 futures: https://finance.yahoo.com/quote/ES%3DF/

Bitcoin

Bitcoin ended 2024 at $93,429. https://finance.yahoo.com/quote/BTC-USD/

Bitcoin's all-time interday high: 126,198 on Oct. 6

Bitcoin's all-time closing high: 124,753 on Oct 6. (that's what Yahoo Finance shows, but cryptocurrencies trade 24/7)

https://finance.yahoo.com/quote/BTC-USD/history/

========================================================

I'm not a fan of the DOW as it is a cherry-picked collection of just 30 stocks that are price-weighted, which is silly. It's as asinine as judging consumer price inflation by picking 30 blue chip consumer items, and weighting them according to their prices. But since there is an automatically updating embedded graphic, here it is. It takes several, like 6 hours, after the close for it to update, like about 10 PM EDT.

(If it still isn't updated, try right-clicking on it and opening in a new tab. #OR# click on https://finance.yahoo.com/quote/%5EDJI/ ).

The Dow closed Thursday at 49,395, and it closed Friday at 49,626, a rise of 0.5% (231 points) for the day

https://finance.yahoo.com/

DOW: https://finance.yahoo.com/quote/%5EDJI/

. . . . . . https://finance.yahoo.com/quote/%5EDJI/history/

DOW

# Election day close (11/5/24) 42,222

# Last close before inauguration day: (1/17/25): 43,488

# 2024 year-end close (12/31/24): 42,544

# 2025 year-end close (12/31/25): 48,063

DJIA means Dow Jones Industrials Average. It takes about 6 hours after the close to update, so check it after 10 PM EDT. Sometimes it takes a couple days (sigh)

I don't have an embeddable graph for the S&P 500, unfortunately, but to see its graph, click on https://finance.yahoo.com/quote/%5EGSPC/

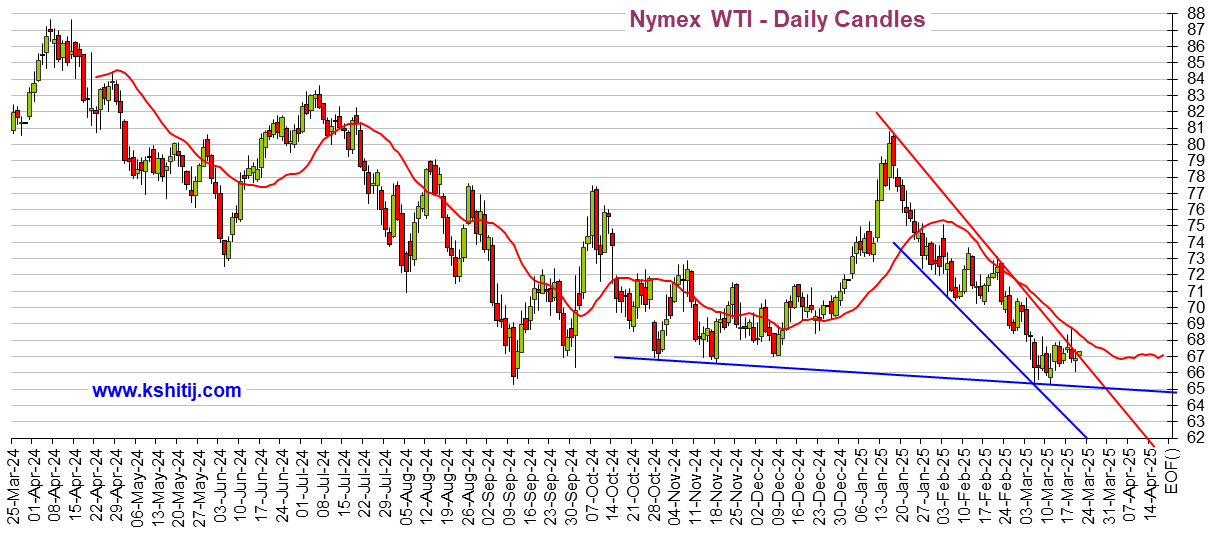

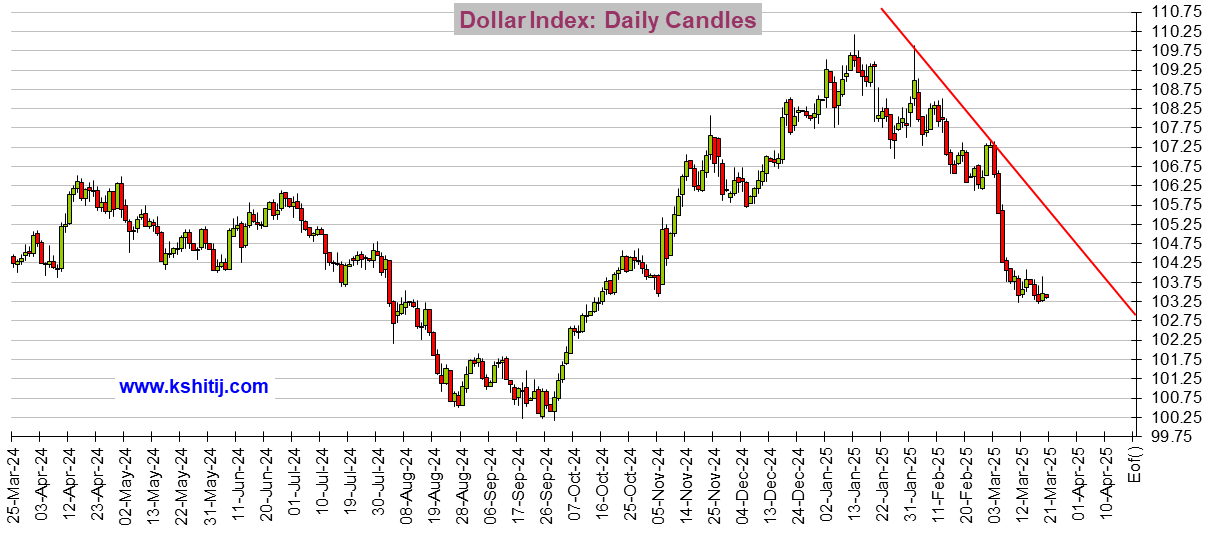

While I'm at it, I might as well show Oil and the Dollar:

Crude Oil

US Dollar Index (DX-Y.NYB)

If you see a tiny graphics square above and no graph, right click on the square and choose "load image". There should be a total of 3 graphs. And remember that it typically takes about 6 hours after the close before these graphs update.

🚨 ❤️ 😬! 😱 < - - emoticon library for future uses

20 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

S&P 500 closed Friday 2/20 at 6910, up 0.7% despite awful 1.4% GDP growth report and hot rising PCE inflation [View all]

progree

Mar 2025

OP

Kicking: update for Thurs. March 6 close. The "Trump Trade" is back underwater after losing 1.8% for the day (S&P 500)

progree

Mar 2025

#2

Kicking: Update: S&P 500 closed Friday at 5770, up 0.5% for the day but still below the election day close

progree

Mar 2025

#3

Update: S&P 500 closed Monday 3/10 at 5615, down 2.7% for the day and 2.9% below the election day close

progree

Mar 2025

#4

Update: S&P 500 closed Tuesday 3/11 at 5572, down 0.8% for the day, briefly fell into correction territory

progree

Mar 2025

#5

S&P 500 closed Wednesday 3/12 at 5599, up 0.5% for the day, but down 3.2% since election day

progree

Mar 2025

#6

Update: S&P 500 closed Thursday at 5522, down 1.4% for the day, and MORE THAN 10% down from the all-time high

progree

Mar 2025

#7

Update: S&P 500 closed Friday at 5639, up 2.1% for the day, and down 2.5% since election day

progree

Mar 2025

#8

Update: S&P 500 closed Monday at 5675, up 0.6% for the day, and down 1.9% since election day

progree

Mar 2025

#9

Update: S&P 500 closed Tuesday at 5615, down 1.1% for the day, and down 2.9% since election day

progree

Mar 2025

#10

S&P 500 closed Tuesday 3/25 at 5777, up 0.2% for the day, down 0.1% since election day, down 6.0% from ATH

progree

Mar 2025

#11