Clamoring to Tax the Rich [View all]

https://prospect.org/economy/2025-09-22-clamoring-to-tax-the-rich/

https://prospect.org/economy/2025-09-22-clamoring-to-tax-the-rich/

The gap between public needs and public revenues, between the incomes of the rich and the incomes of everyone else, continues to widen. New York may be home to more than 100 billionaires, but most of the city’s parents struggle to afford child care for their preschoolers. Paris is home to the world’s wealthiest merchants of luxury goods, but the government is

threatening to enact budget cuts that would reduce funding to hospitals and schools in order to balance its budget.

In those two cities, democratic socialists are proposing similar solutions that have widespread popular support. In New York, Democratic mayoral nominee Zohran Mamdani, who has a commanding lead in the polling for November’s election, has proposed increasing the income tax on city residents with incomes over $1 million by two percentage points, with the proceeds to go to free universal child care and free bus travel. (The state government would have to approve that increase.) In Paris, the nation’s Socialist Party is demanding a 2 percent tax on wealth in excess of 100 million euros, which would close the nation’s projected budget deficit without cuts to social spending, as a condition for supporting the government of the newly appointed prime minister.

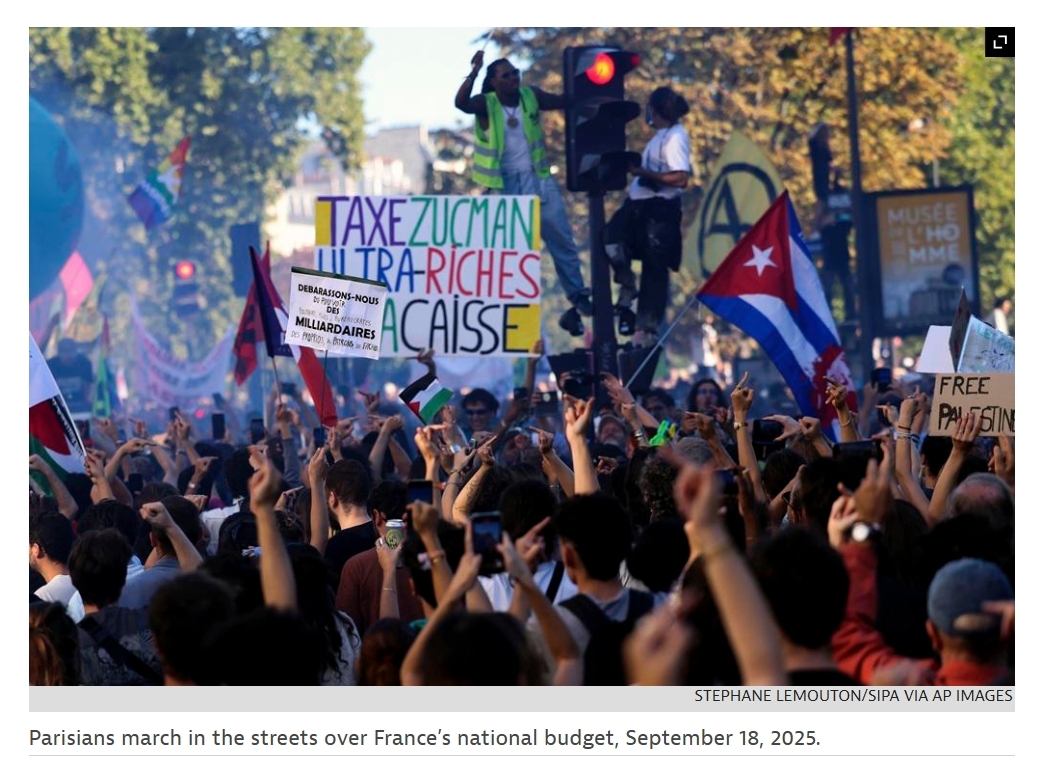

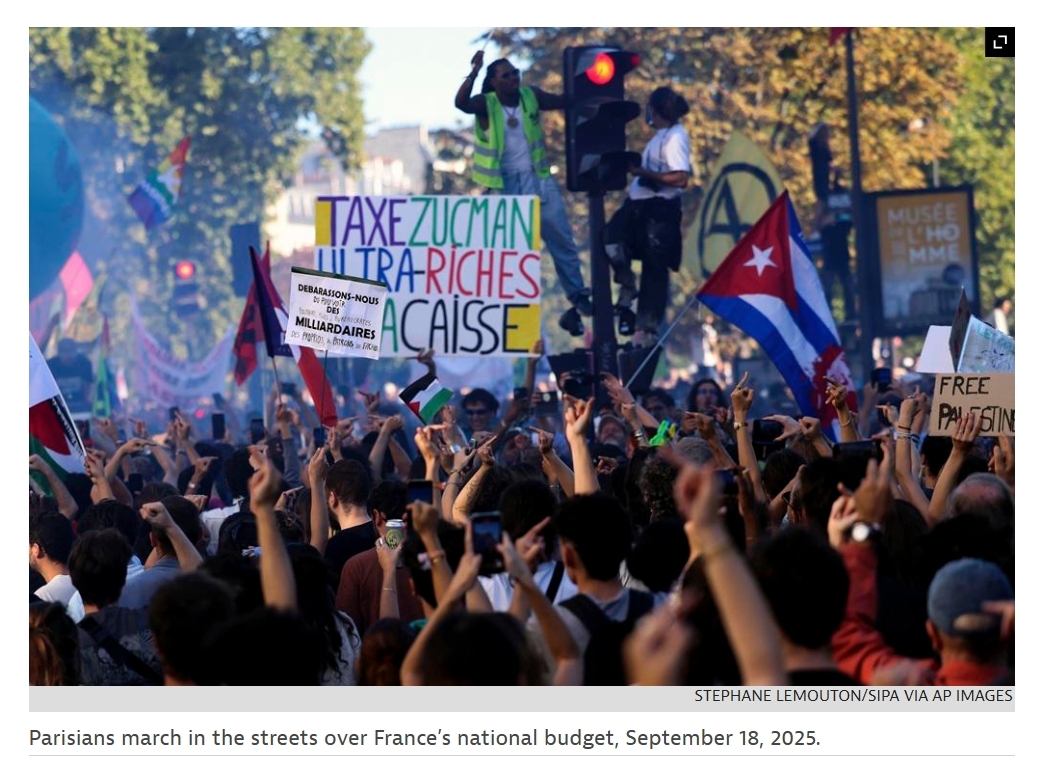

The architect of the French socialists’ proposal, for which hundreds of thousands of demonstrators have

clogged the streets of Paris and other cities in recent days, is Gabriel Zucman, an economics professor at the Paris School of Economics and UC Berkeley, and a frequent collaborator with Emmanuel Saez and Thomas Piketty on papers that deal with the actual rates of taxation on the rich and everybody else. In 2021, when

I profiled Berkeley’s Economics Department for the

Prospect, I noted that the department was at the forefront of a shift in the discipline, from positing theories to reporting on actual data (led by department chair David Card, whose work with Alan Krueger on the effect of minimum-wage hikes on employment, which turned out to be negligible, was to win him the Nobel Prize). Piketty, Saez, and Zucman’s work on the preceding century of income tax payments in the United States was both revelatory and, for economics professors, revolutionary. Zucman carried such research even further by documenting the volume and rate of income tax evasion through the rich shifting their income to nations that are tax havens—for which he was awarded the John Bates Clark Medal for producing the most significant work by an economist under 40.

Today, Zucman has become a household name in France: The Socialists’ proposal is commonly known as the Zucman Tax, and he is all but ubiquitous on French media in defense of the proposal. Not surprisingly, that tax has come under intense attack by France’s billionaires, some of whom have termed it “communist.” Zucman has responded by noting that it would indeed be communist if it took 100 percent of their wealth, but taking 2 percent falls 98 percent short of that. Like their French peers, many of New York’s billionaires have predicted the fall of civilization if their taxes are raised, but it’s similarly hard to see how raising the city’s current rate of 10.9 percent for single filers on that portion of their yearly incomes in excess of $25 million to 12.9 percent would bring the walls of the temple tumbling down.

snip