Environment & Energy

Related: About this forumGreen Hydrogen Plans Evaporate; Projects Fold, PlugShare Deeply In Debt, AI Driving Demand For Cheapest Possible Energy

EDIT

The late 2010s were a euphoric time for clean energy developers. Renewables construction shot forward despite President Donald Trump’s 2016 campaign vows to bring back coal. Low interest rates paired nicely with the low but predictable returns that renewables projects could generate. Entrepreneurs imagined ways to capitalize on the imminent abundance of clean electricity by converting it into hydrogen. The Covid-19 pandemic slowed the pace of activity, but then the Biden administration passed the 2021 infrastructure law, which designated $7 billion for a series of “hydrogen hubs” around the country. The administration chased that with the Inflation Reduction Act, which included a lucrative credit for the production of clean hydrogen, up to $3 per kilogram. A new multibillion-dollar industry was in the offing, and visionaries prepared to make their moves, as soon as the Internal Revenue Service published its guidance on how to claim that credit.

Then they waited. And waited. “At $3 per kilogram, if your plant did not qualify for that and your neighbor’s plant did, then you’re out of business,” said Brenor Brophy, who ran development for Plug Power’s hydrogen production business in the early 2020s (he is no longer with the company). But there was no airtight way of ensuring one’s project would qualify until the final rule came out. “The Treasury Department sat on that for two and a half years,” which was worse for the industry than if the credit were never created, Brophy added.

EDIT

Similarly, in that bright period before Biden-era inflation set in, hydrogen boosters saw a clear path to achieving cost declines akin to what solar and batteries had achieved. Legacy dirty hydrogen could be made for about $1 per kilogram; the green stuff cost several dollars more. But a technological learning curve could close that gap, the thinking went, and sway large industrial buyers. In 2021, the Biden Department of Energy set a goal to get green hydrogen costs down to $1 per kilogram within a decade. Unfortunately, the cost declines that experts expected in the early 2020s never materialized. A late-2024 DOE report on clean hydrogen commercialization noted that costs had gone up, not down, by $2 to $3 per kilogram since its March 2023 analysis. The report cites higher real-world installation costs, rising interest rates, and escalating prices for clean power to meet the IRS requirements for the tax credit.

EDIT

Electrolysis devours electricity, which is fine in a world of cheap and abundant power. But, suddenly, any fledgling hydrogen project has to compete with much better-funded rivals in electric gluttony: AI computing hubs. The business calculus of clean hydrogen necessitated driving down energy costs as much as possible to compete with cheap dirty hydrogen. For green hydrogen ventures to succeed, they would need to render their product a cheap commodity. AI customers, on the other hand, are flush with cash and willing to pay top dollar to anyone who could deliver them gobs of power as soon as possible.

EDIT

https://www.canarymedia.com/articles/hydrogen/green-industry-trump-tax-credits

thatdemguy

(615 posts)Even when made with renewable energy there is a loss at every stage. Use solar to make it and you spent 100% of the solar to make from 50% to 70% of the equivalent. If you then use that hydrogen in a motor you get an average of 30% of that energy from it. If you use it in a fuel cell you get 50% average efficiency. So at best you get 25 % of the energy back that was made with solar.

Hydrogen is nothing but a battery with 25% efficiency, at best and that does not even include the energy to compress and cool it for storage. Now if its made from natural gas, you might get 30% of the energy that the natural gas had in the first place with the same amount of green house gasses.

Instead of wasting energy/money trying to make hydrogen make grid scale batteries to store the solar for use at night. A lifepo4 battery has about 95% efficiency.

OKIsItJustMe

(21,709 posts)As a result, grey hydrogen prices skyrocketed as well.

Natural gas prices have come back down, and so (naturally) grey hydrogen prices have as well, but it’s an indication of what future shortages may bring. ("Green hydrogen" prices are coming down to be competitive to "grey hydrogen.” )

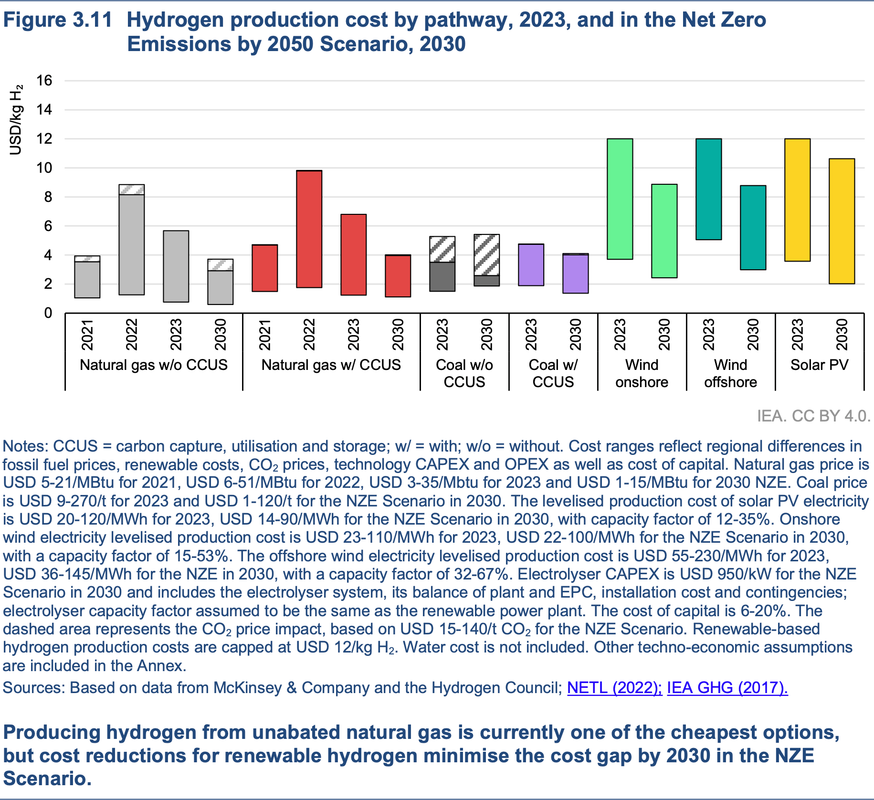

IEA (2024), Global Hydrogen Review 2024 - IEA, Paris https://www.iea.org/reports/global-hydrogen-review-2024 - Page 82 - Figure 3.11 - Hydrogen production cost by pathway, 2023, and in the Net Zero Emissions by 2050 Scenario, 2030, Licence: CC BY 4.0

OKIsItJustMe

(21,709 posts)Alex Morrison

…

The new report, by Cambridge Econometrics and the University of Exeter, explores whether targeted government policies could spark a cost-competitive green hydrogen industry globally.

The researchers – who found that current policies are insufficient to achieve this at the global level – simulated the effects of a global mandate requiring the use of green hydrogen in fertilisers, and a global carbon price on hydrogen production.

…

“However, green hydrogen is the only realistic option for decarbonising fertiliser production and for making clean steel, and it may have a role in other sectors such as aviation.

“Achieving the ‘tipping point’ of cost-competitive green hydrogen is tough but necessary, and will likely require strong and sustained policy support.”

…